23+ tax deduction mortgage

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Get an idea of your estimated payments or loan possibilities.

Strategies For Minimizing Estimated Tax Payments

The nonrefundable EV tax credit ranges from 2500 to 7500 for tax year 2022 and eligibility depends on the vehicles weight.

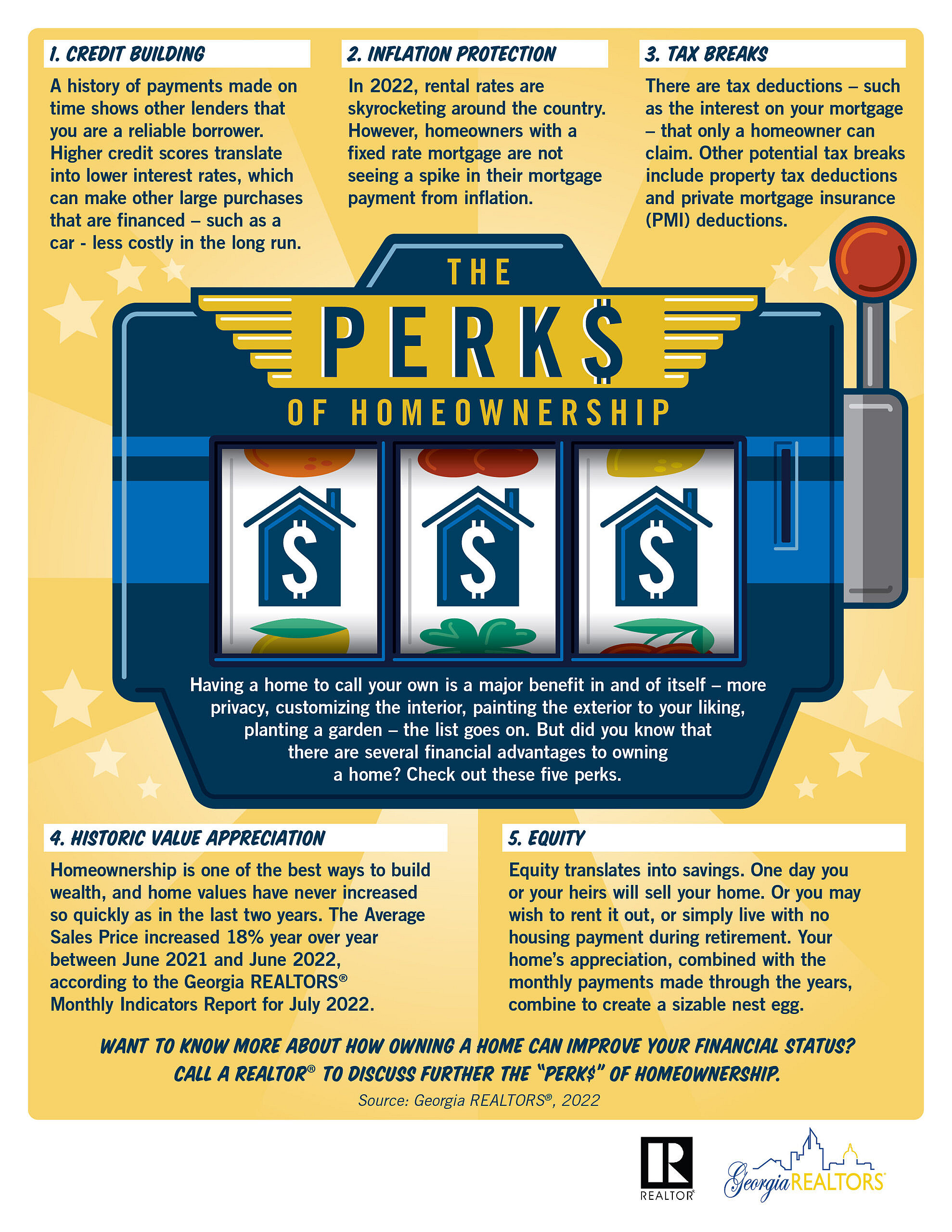

. Web The itemized deduction for mortgage insurance premiums was extended through 2021 and tax filers were able to the deduction on line 8d of Schedule A Form. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Start Today to File Your Return with HR Block.

Edit your 936 online. They also both get an additional standard deduction amount of. Once your income rises to this level.

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. Web How to claim the mortgage interest deduction. For married taxpayers filing a separate.

Web Most homeowners can deduct all of their mortgage interest. Mortgage interest points and home equity debt can reduce your burden. Web Is mortgage interest tax deductible.

Web The deduction for mortgage interest is available to taxpayers who choose to itemize. Add the Irs mortgage deduction for editing. Single or married filing separately 12550 Married filing jointly or qualifying widow er.

Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have. Web For 2021 tax returns the government has raised the standard deduction to. Electric vehicle tax credit.

Ad Dont Leave Money On The Table with HR Block. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. Web Here is the workaround.

It details how much you paid in. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Home Mortgage interest being limited. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Look in your mailbox for Form 1098.

The good news is that you may. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are.

Get Your Max Refund Guaranteed. Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. For tax years prior to 2018 your mortgage interest deduction is.

Click the New Document option. Single taxpayers and married taxpayers who file separate returns. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Learn How Simple Filing Taxes Can Be. 12950 for tax year 2022 Married taxpayers who. However higher limitations 1 million 500000 if.

Web Mortgage-Interest Deduction. It allows taxpayers to deduct interest paid up to 750000 375000 for married filing. Web This newsletter at a glance Tax season is upon us so its time to check for homeowners tax breaks.

Try our mortgage calculator. Please click on the attached link. Also your adjusted gross income cannot go over 109000.

How It Works in 2022 - WSJ About WSJ News Corp is a global diversified media and information services company focused on creating. Web Standard deduction rates are as follows. 12950 for single and married filing separate taxpayers.

Heres how it works. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Your mortgage lender sends you a Form 1098 in January or early February.

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Home Mortgage Loan Interest Payments Points Deduction

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Is Mortgage Interest Tax Deductible In 2023 Orchard

Lorkovic Wealth Management What Financing Options Are Available When Purchasing Equipment

Mortgage Interest Tax Deduction What You Need To Know

Collette Mcdonald Collettemcdonal Twitter

Open Esds

Mortgage Tax Deduction Calculator Homesite Mortgage

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Maximum Mortgage Tax Deduction Benefit Depends On Income

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Learn How The Student Loan Interest Deduction Works

Salary Certificate Templates 37 Word Excel Formats Samples Forms Certificate Templates Certificate Format Salary

Housing In Ten Words The Baseline Scenario

Coming Home To Tax Benefits Windermere Real Estate

What Do Mortgage Lenders Look For On Your Tax Returns Better Mortgage